Loan Loss Mitigation Model (PLLM)

- Applications

- Risk Management

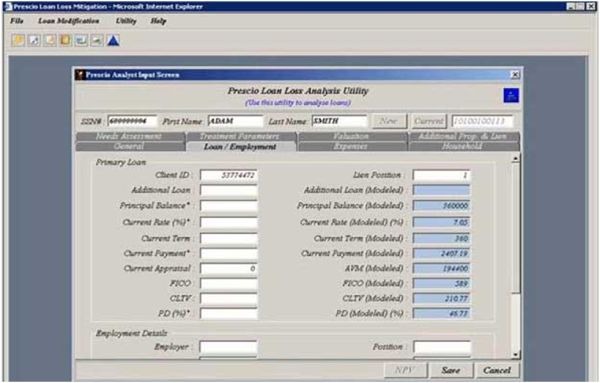

The purpose of the model is to assess stressed mortgages and determine the maximum payment the borrower can and will pay while determining the best modification approach from the standpoint of the lien holder.

In this case, Prescio partnered with a large U.S. based consulting firm to develop a mortgage modification and loss mitigation model. The joint venture was a follow on piece from an earlier model development project for an international bank’s southeast U.S. mortgage business. The joint venture adapted the model into a web based software application and enhanced the data analysis, segmentation, and portfolio capabilities of the original modeling venture.

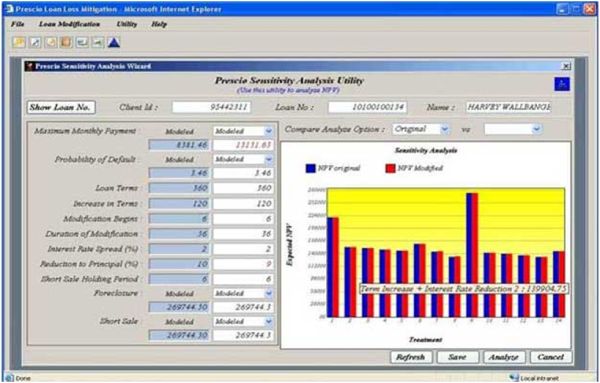

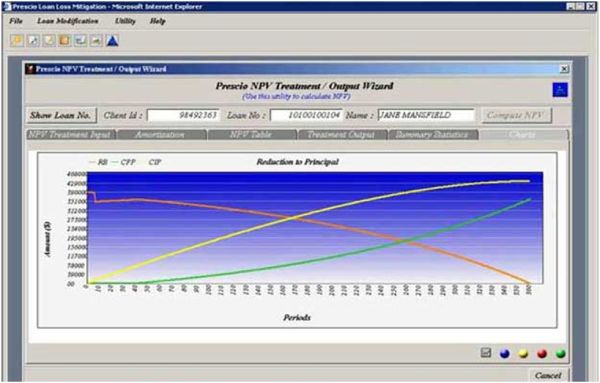

The model does so through predicting probability of default, assessing future home valuation and disposition costs, and computing a future value of cash flows. Loan level sensitivity analysis, extensive data analysis, and portfolio net present value analysis are made available. Extensive reporting and graphical presentation capabilities are built into the application. The application is currently in a marketing and future development stage.