Operational Risk Model Application (OpRisk)

- Applications

- Risk Management

The SAS based application was developed internally by the statistical and quantitative modelers of the Bank.

In this case, a major mid-west based US Bank requested Prescio to validate their Extreme Value Theory based Operational Risk model. Prescio’s personnel included business domain experts, statisticians, mathematicians, SAS experts and project managers. Discussions of the Prescio team with the executives of the risk management and the quantitative group of the Bank led to validation of the different facets of the model according to standard validation practices of the industry.

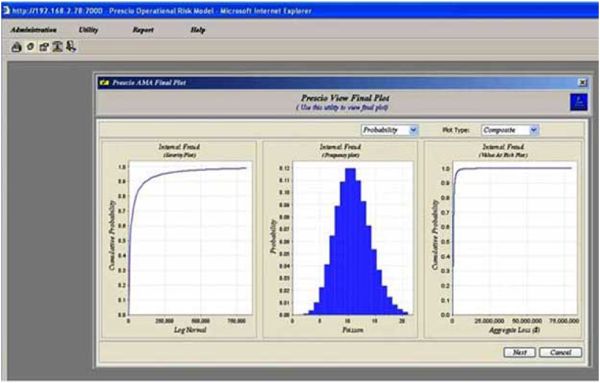

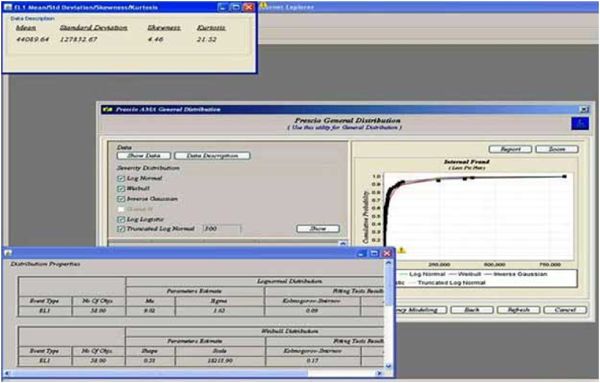

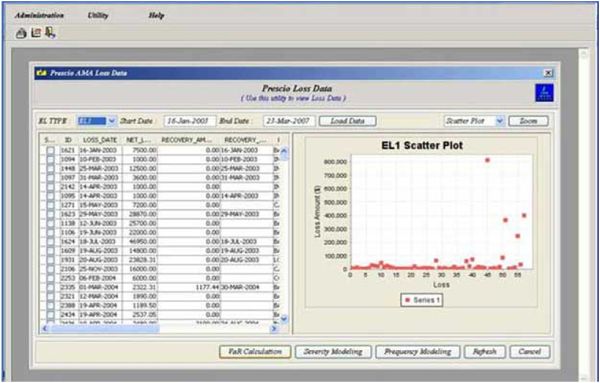

Prescio performed a multiple step validation process which included among others analysis of the theoretical fundamentals of the model, analysis of the business fundamentals, analysis of the internal data, analysis of the Structured Scenario data, determination of the distributions applicable to individual loss events, combining of the internal and structured scenario data, addressing issues related to the Extreme Value theory, Pareto Distributions and validating the SAS code. Prescio was able to deliver the clients’ requirements within a very tight delivery schedule. Prescio’s performance resulted in follow-on work for other Basel related models in the commercial and retail Credit.